Indepth Guide to Digital Transformation for in 2023

Overwhelming OTT: Telcos' growth strategy in a digital world Incumbents are now asking if digital is a threat to or an opportunity for their business model. Beyond operational…

Telcos want OTT communications apps WhatsApp, Signal and Telegram to

The EU aims to invest 160 billion euros by 2027 to help close the technology gap that exists between Europe and its competitors on a range of metrics 3 —a move likely to increase demand for new telco services. But a more powerful driver of growth, and one that is entirely in operators' own hands, lies in the focus that delayering can achieve.

2023년 가트너 선정 10대 전략 기술 트렌드 모두의연구소

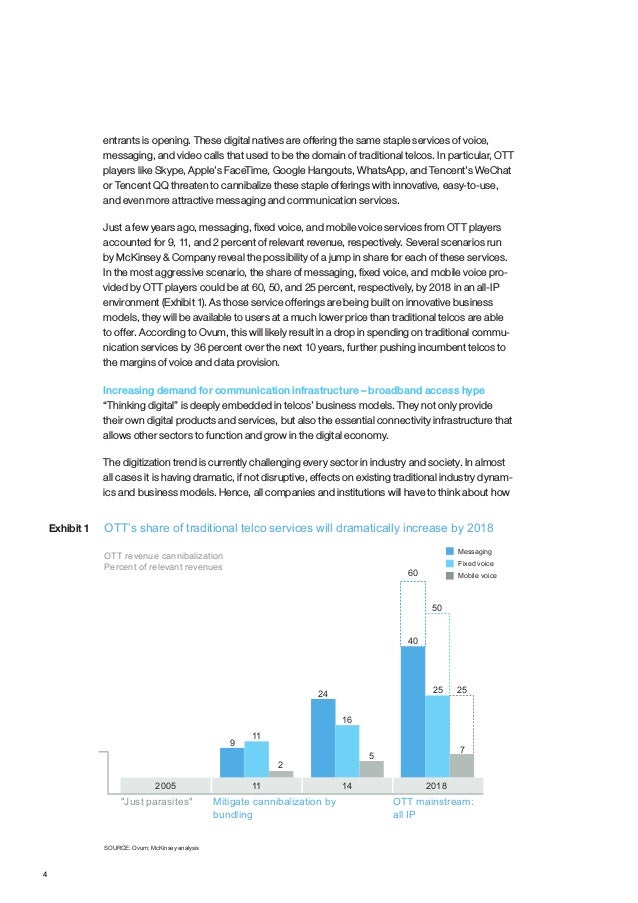

A great article from McKinsey around the OTT - telcos growth strategy in a digital world. Referencing Ovum throughout.

Overwhelming otttelcosgrowthstrategyinadigitalworld

This will present a big challenge in two ways. First, some industry analysts expect telcos' global operating expenditures to increase by billions of dollars this year. Second, the next wave of material reductions in operating costs will likely come from substituting computer processing power for people.

Total Thing You Need to Know About OTT App Development Time, Cost

1. Returning to value growth. After years of stagnation, telcos will focus more than ever on creating, capturing and returning more value to shareholders. One important way is through inorganic growth. In the past 12-18 months, we've seen an acceleration of deals in the telco space, and the pace is not expected to slow down this year.

Overwhelming otttelcosgrowthstrategyinadigitalworld

Convergence India expo is at the forefront of India's 'Digital Revolution' and a hub for future technologies, innovation and everything that is 'smart' and 'sustainable'.. • Embracing the OTT revolution • Overwhelming OTT: Telcos' growth strategy in a digital world • A new matrix for OTT business • Original Content.

Overwhelming otttelcosgrowthstrategyinadigitalworld

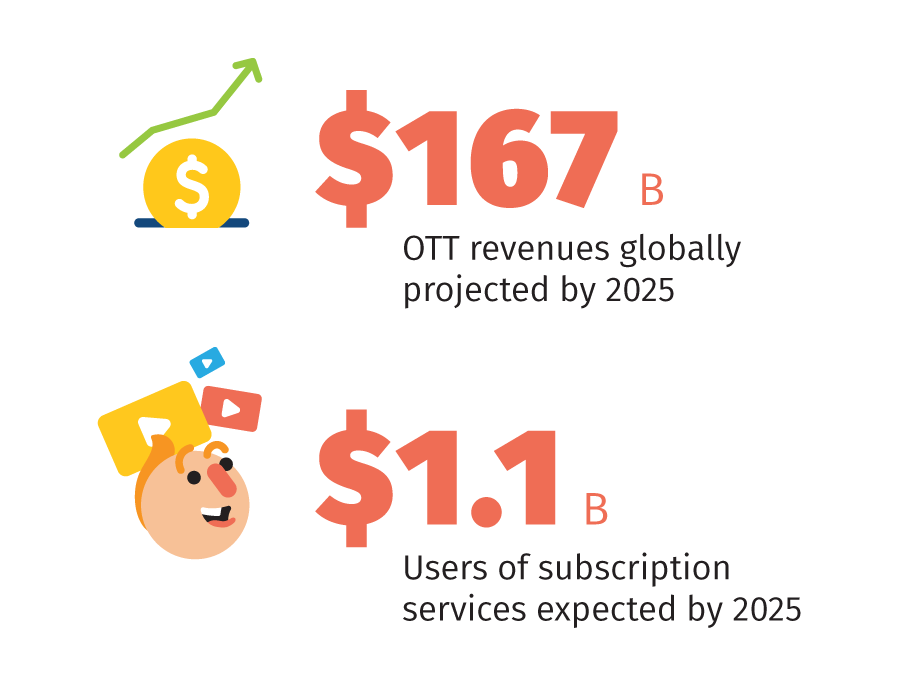

mainly in emerging markets, is expected by 2025 - the door for new over-the-top (OTT) Overwhelming OTT: Telcos' growth strategy in a digital world Overwhelming OTT: Telcos' growth strategy in a digital world Digital is enabling the rise of OTT and pushing telcos to the margins of voice and data provision

Overwhelming otttelcosgrowthstrategyinadigitalworld

As the overall digital market grows—an additional billion middle-tier customers for telcos, mainly in emerging markets, is expected by 2025—the door for new over-the-top (OTT) entrants is opening. These digital natives are offering the same staple services of voice, messaging, and video calls that used to be the domain of traditional telcos.

Overwhelming otttelcosgrowthstrategyinadigitalworld

1 Jürgen Meffert and Niko Mohr, "Overwhelming OTT: Telcos' growth strategy in a digital world," January 2017, McKinsey.com. Exhibit 1 Over-the-top share of relevant revenue, % Messaging 2011 9 11 2 5 7 16 25 24 40 2014 2018E 2011 2014 2018E 2011 2014 2018E Fixed voice Mobile voice

Overwhelming otttelcosgrowthstrategyinadigitalworld

As a group, TeBIT participants have an intermediate digital-maturity level—trailing industries such as media and entertainment as well as software and IT services. TeBIT telcos lag most markedly in purpose and strategy, but they have high ambitions for the future. Seven best practices can help telcos boost their digital maturity.

OTT as a Source of Growth and Revenue for Telcos

experiences, enabled through collaborative ecosystems, with business models spanning the digital and physical world. It is the context within which telcos can hope to become the champions of connected technologies helping the world run better mentioned earlier. Figure 1: The Coordination Age thrives on innovation Source: STL Partners DEMAND CHANGES

-Market-Size-2021-to-2030.jpg)

Over the Top (OTT) Market Size, Growth, Report 2023 to 2032

Overwhelming OTT: Telcos' growth strategy in a digital world. Read the article. 3. Which regulatory issues are vital? Regulations play a crucial role in shaping the telecommunications sector. Areas that are especially vital include industry structure (for instance, fiber wholesale regimes, tower and spectrum sharing) and competition, spectrum.

.png)

Data's Future is Now Unlocking Growth Strategies for Telcos Business

Request PDF | On Oct 21, 2019, Angels Dasi and others published VUCA and the Future of the Global Mobile Telco Industry | Find, read and cite all the research you need on ResearchGate

Telco’s B2B rebound and recovery strategy LaptrinhX

Over the past few weeks, McKinsey [1] and the World Economic Forum (WEF) [2] have weighed in on the debate about long term growth prospects in the telecommunications sector.. Overwhelming OTT: Telcos' growth strategy in a digital world, McKinsey & Co., January 2017 [2] Digital Transformation Initiative - Telecommunications Industry.

Overwhelming OTT Telcos’ growth strategy in a digital world McKinsey

AI in telecommunications has proven itself essential to the telecoms' digital transformation strategy as it addresses the key challenges inches 2023. Skip to content. Products. Pre-Call Automation; Visuals Contact Centers; Visual Pitch Services; Visual Self-Service; Visual Intelligence;

Overwhelming otttelcosgrowthstrategyinadigitalworld

new momentum to the digital B2B market. Growth opportunities for telcos are waiting to be won. 22B is the place to be B Most telcos know about the B2B opportunity, including its inherent challenges, but are having a hard time operationalising it. Overwhelming OTT: Telcos' growth strategy in a digital world, McKinsey and Company1.