Break Even Point (Formula, Example) How to Calculate Break Even Point

Why It Matters; 3.1 Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin; 3.2 Calculate a Break-Even Point in Units and Dollars; 3.3 Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations; 3.4 Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing.

How To Use A Break Even Point Calculator For Business Profitability

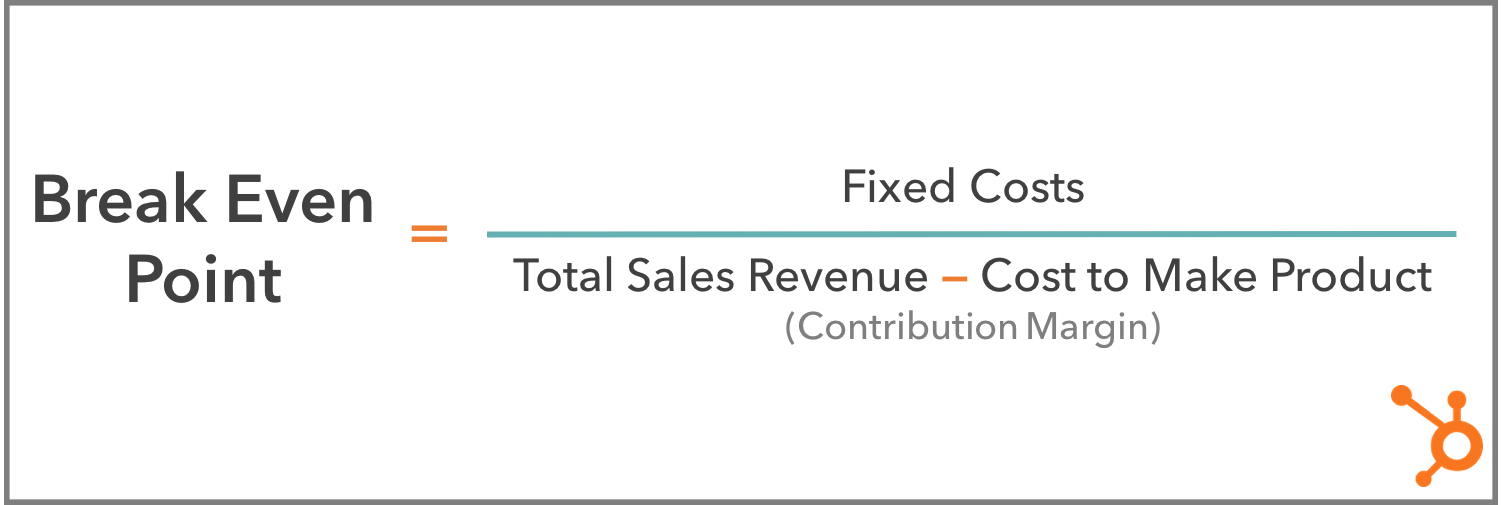

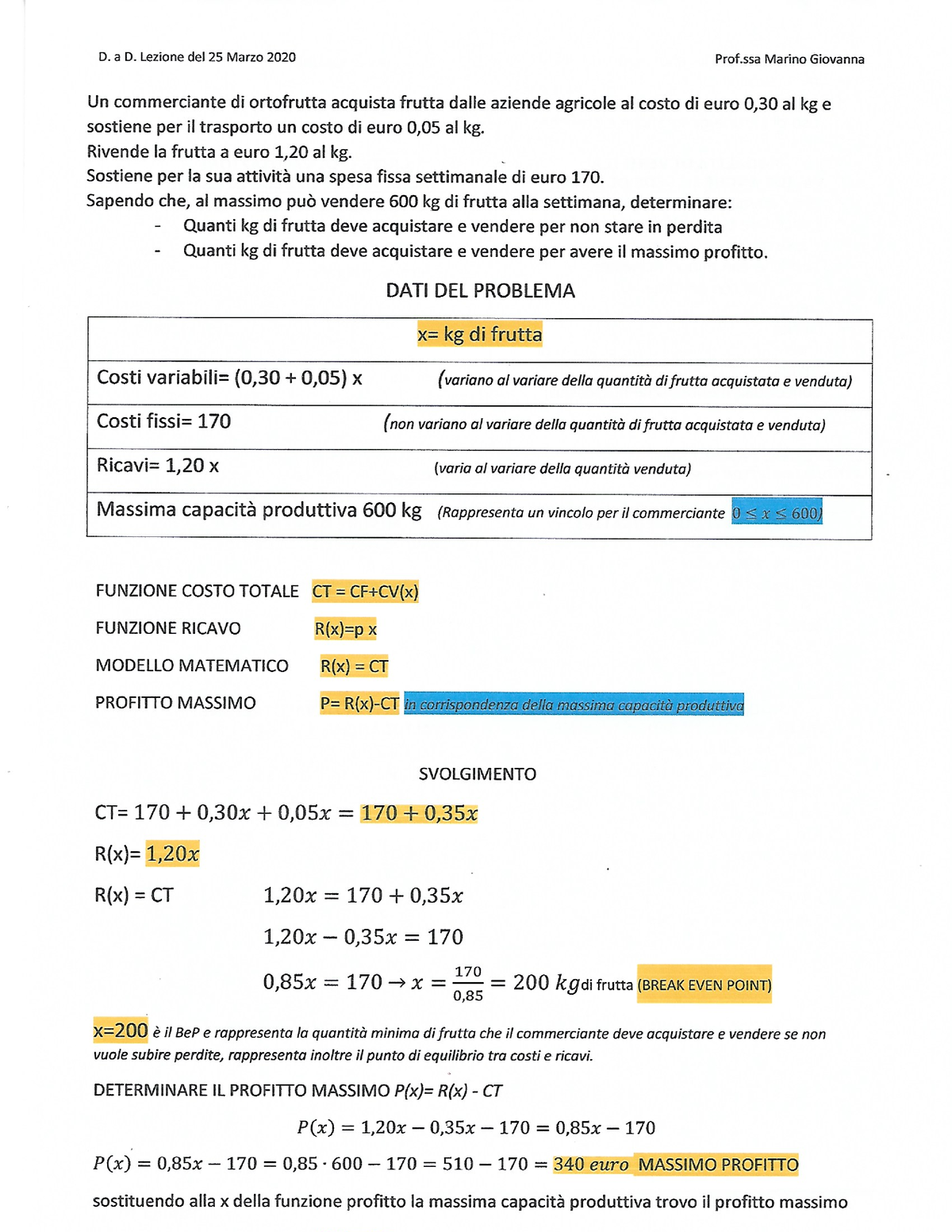

Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit. So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00.

Wayne Lockwood How to Calculate Your Business’s Break Even Point

What is break-even point? In economy, the break even point is when you don't make a profit and you don't lose money either. In other words, your revenue or income is equal to your expenses. Say R = revenue and C = cost R = C Example #1: It costs a publishing company 50,000 dollars to make books.

How to Calculate the Break Even Point and Plot It on a Graph

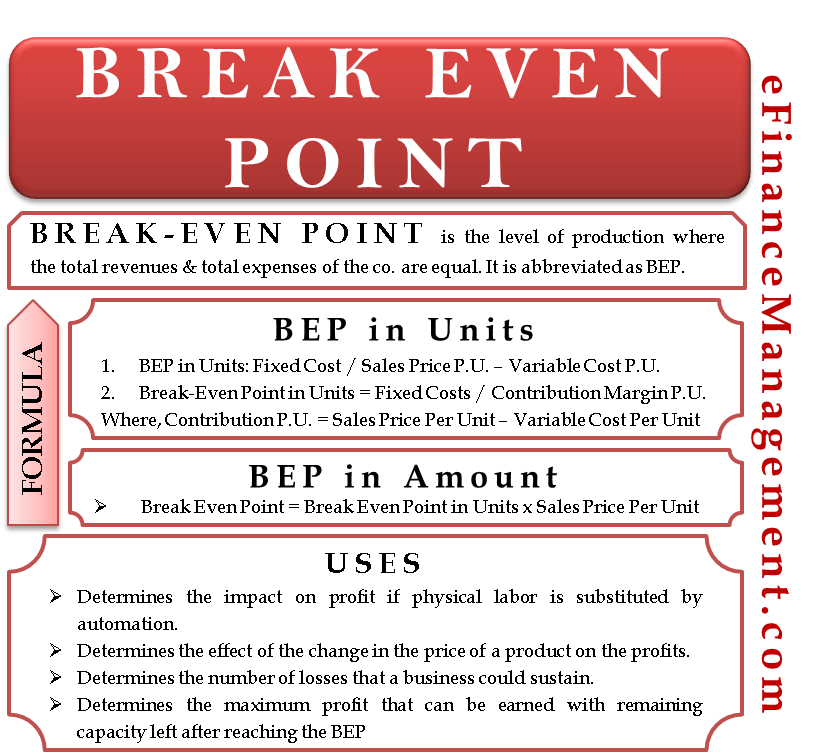

Il Break even point: cos'è e come si calcola.Il Break even point o punto di pareggio, rappresenta il punto di equilibrio, è la quantità di ricavi necessari a.

break even point Archivi MarketingeImpresa

A Quick Guide to Breakeven Analysis by Amy Gallo July 02, 2014 In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You've.

How to calculate Break Even Point (BEP)? Project Management Small

Break-Even Point Definition. In accounting, economics, and business, the break-even point is the point at which cost equals revenue (indicating that there is neither profit nor loss). At this point in time, all expenses have been accounted for, so the product, investment, or business begins to generate profit. The concept of "breaking even.

Break Even Point (BEP) Formula + Calculator

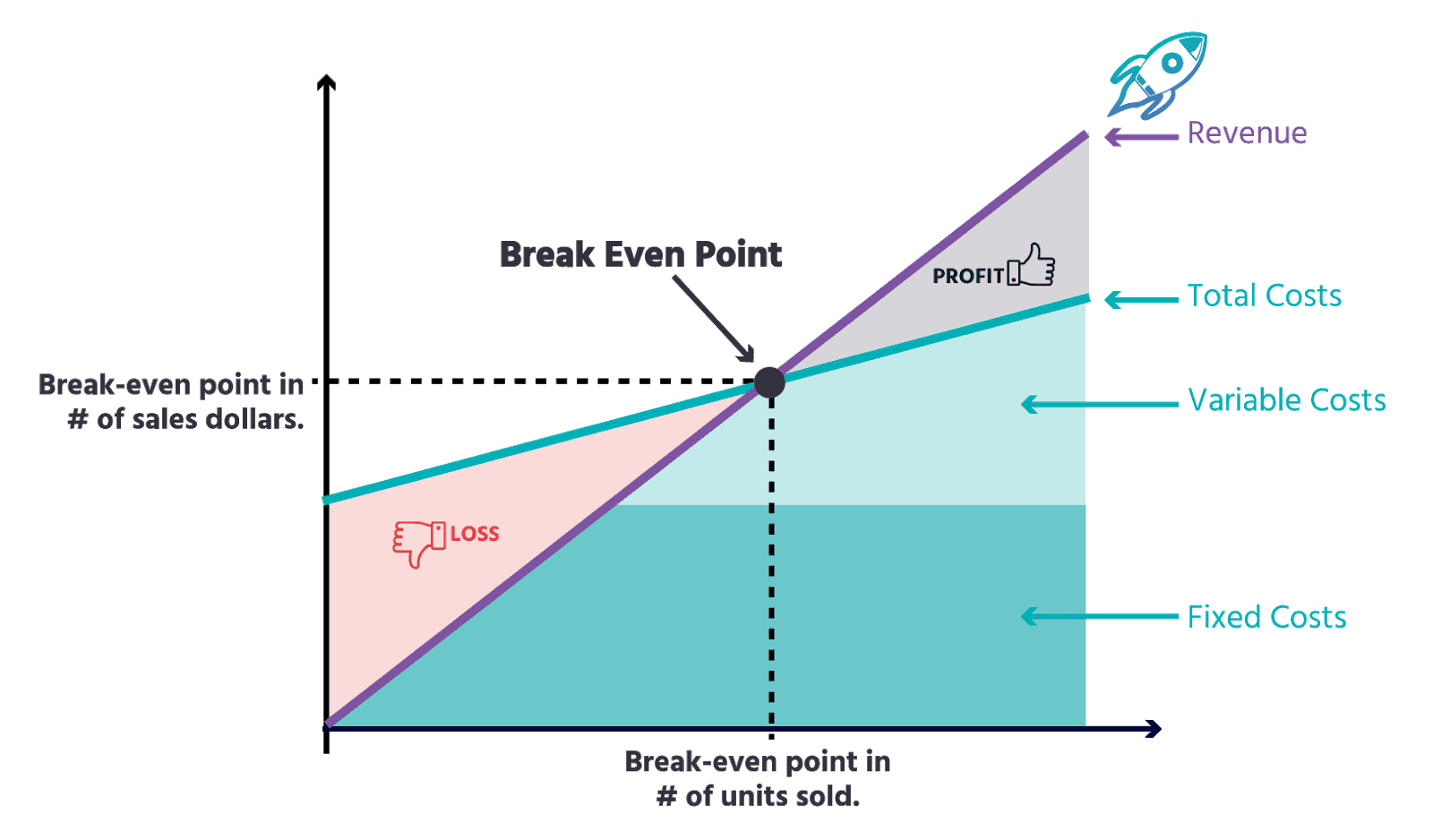

A break-even point analysis is used to determine the number of units or dollars of revenue needed to cover total costs ( fixed and variable costs ). Key Highlights Break-even analysis refers to the point at which total costs and total revenue are equal.

How to Calculate the BreakEven Point for a Business

Formula to Calculate Break-Even Point (BEP) The formula for break-even point Break-even Point Break-even analysis refers to the identifying of the point where the revenue of the company starts exceeding its total cost i.e., the point when the project or company under consideration will start generating the profits by the way of studying the relationship between the revenue of the company, its.

break even point in "Enciclopedia della Matematica"

Still Going Strong on Calculus. When Mathematica 1.0 was released in 1988, it was a "wow" that, yes, now one could routinely do integrals symbolically by computer. And it wasn't long before we got to the point—first with indefinite integrals, and later with definite integrals—where what's now the Wolfram Language could do integrals better than any human.

How to Calculate the BreakEven Point for Your Business Paychex

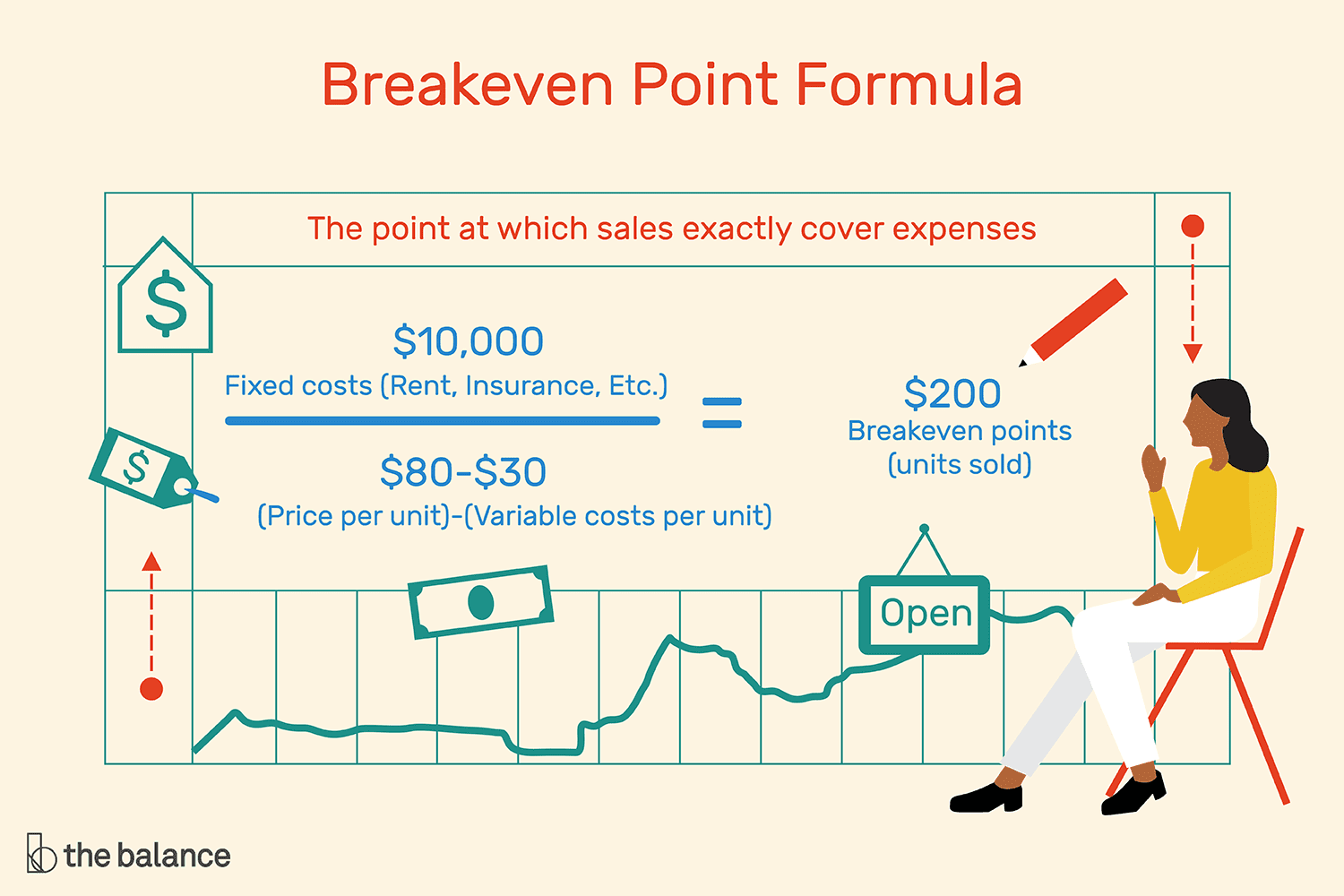

To calculate your company's breakeven point, use the following formula: Fixed Costs ÷ (Price - Variable Costs) = Breakeven Point in Units. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all.

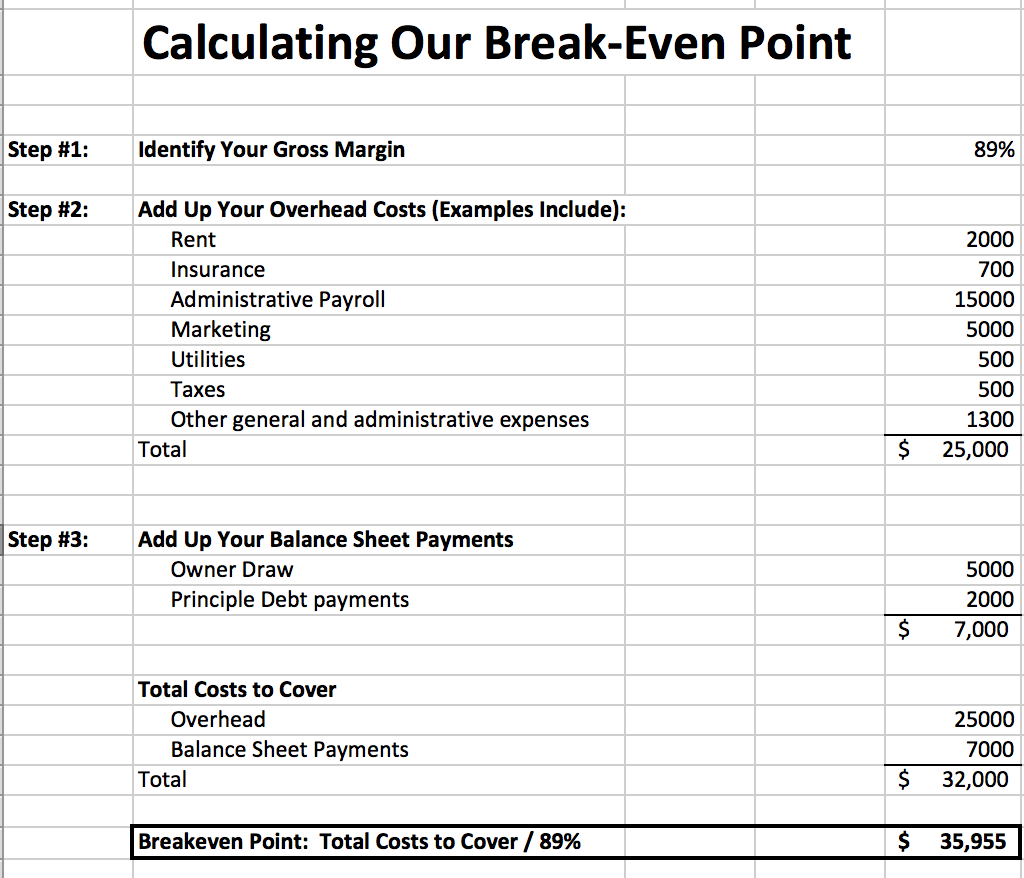

How to Calculate My Business' Break Even Point Trailhead Accounting

The breakeven point ( breakeven price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two.

Angle of Incidence BreakEven Analysis, Margin of Safety BBAmantra

Break Even Calculator The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even. Our online tool makes break-even analysis simple and easy.

Break EVEN Point Matematica Finanziaria Studocu

At the break-even point fixed sunk costs and marginal costs equal the marginal revenue. The yellow area gives the total loss for a number of units produced and sold which is less than the number of units needed to break even. The green area gives total profits accumulated after passing that critical point.;

Break Even Point Definition, Formula, Example, Uses, etc.

Il break even point definisce il punto in cui i costi totali (fissi + variabili) per una produzione o un prodotto sono equivalenti al fatturato complessivo. Break even point: le basi

Break Even Point (BEP) Formula and Units Calculation

The break-even point, or break-even quantity, is the number of units a company needs to sell in order to earn $0 and lose $0. The definition of the break-even point is that it is the quantity of.

Breakeven Point Meaning, Advantages, Disadvantages and Examples

If breakeven point model represents zero profit scenario, is it possible as an entrepreneur to set the right level of production so as to realize a specific profitability level. This question can be answered by using an example; Example. FTZ co. ltd is a producer of medicinal juice for Covid-19 supplement purposes. The cost per unit data for.